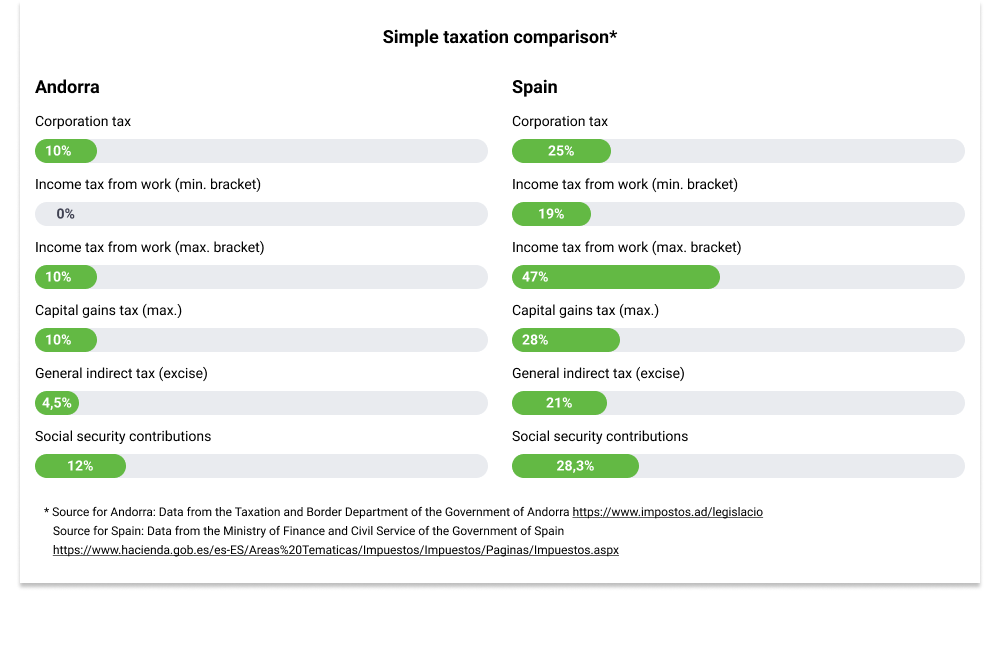

The tax advantage in Andorra

The tax system in the Principality of Andorra allows you to set up your company and plan your personal taxes with great advantages.

10%

Corporation tax

10% en general

in general. Income tax for individuals or companies not resident for tax purposes in Andorra (NRIT):

4,5%

General Indirect Tax (IGI).

9,5%

for financial activities

10% en general

in general. Personal income tax (IRPF) for residents in Andorra:

- Reduccions: Mínim personal de 24.000 €; 3.000 € per rendes de l’estalvi.

- Exempcions: guanys de capital per vendre accions i participacions de fons si tenen una participació inferior al 25 % o si la participació es manté durant més de deu anys.

- Taxes paid abroad are deductible with limits.

- Dividends from Andorran companies are exempt (including investment vehicles: SICAVs, funds, etc.).

Font: Departament d’Estadística, Govern d’Andorra.

Dades: desembre de 2021.